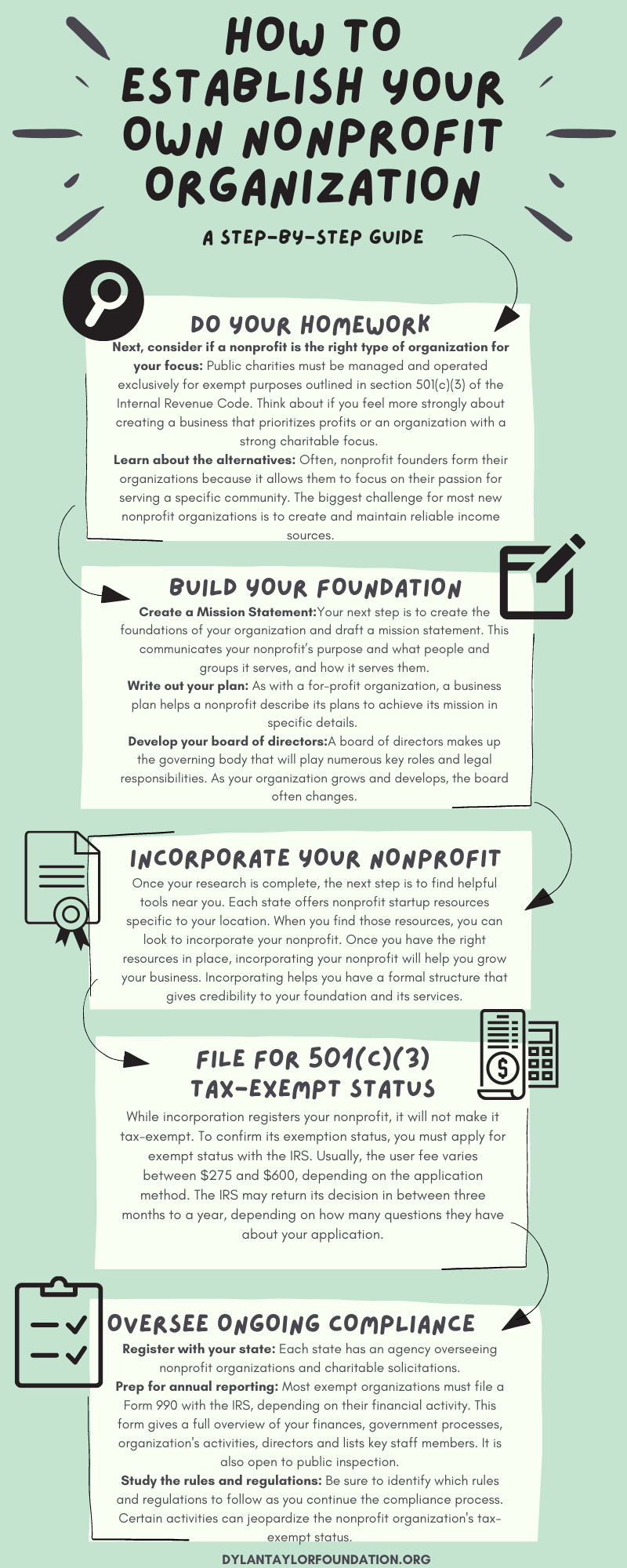

A Step-by-Step Guide on How to Establish Your Own Nonprofit Organization

Creating a nonprofit can be a rewarding way to give back to your community and help people in need. Forming a nonprofit requires commitment and it’s essential to understand the process involved in developing your organization before moving forward with the project.

Establishing and sustaining an active nonprofit can take years of determination and developing a coherent strategy. It’s best to be as prepared and knowledgeable about where you can find support and resources to help your nonprofit startup thrive.

Below is a step-by-step guide to building your nonprofit organization:

1. Do your homework.

Research if other businesses (nonprofits, government or for-profit) are doing similar work in your community. A thorough way to do this is to conduct a needs assessment. It’s often harder to get financial support if you are duplicating the work of existing organizations rather than improving upon or adding to their work. During this process, it’s important to find the demographic or population data that indicates a need for your services and to explain how that need is not currently met. Demographic information on local communities can be found through resources such as the Urban Institute’s interactive maps on various issues or American Fact Finder, the U.S. Census bureau that offers community-based information.

Next, consider if a nonprofit is the right type of organization for your focus.

Public charities must be managed and operated exclusively for exempt purposes outlined in section 501(c)(3) of the Internal Revenue Code. Think about if you feel more strongly about creating a business that prioritizes profits or an organization with a strong charitable focus. Nonprofits often aren’t readily eligible to get grants right away. You can learn more about whether a nonprofit is right for you by learning about the advantages and disadvantages of such an organization.

Learn about the alternatives. Often, nonprofit founders form their organizations because it allows them to focus on their passion for serving a specific community. The biggest challenge for most new nonprofit organizations is to create and maintain reliable income sources. Most experts agree that less than half of nonprofit startups last beyond five years. It’s estimated that of those that survive, one-third are in financial distress. Considering the alternatives could even help you strategize how to operate as a nonprofit but with far less cost, which can help you focus on your mission to help your community. At the same time, it allows you to develop the expertise and support that will help you even if you eventually decide to create a separate organization.

2. Build your Foundation

Create a Mission Statement.

Your next step is to create the foundations of your organization and draft a mission statement. This communicates your nonprofit’s purpose and what people and groups it serves, and how it serves them. Every decision taken within your organization should further support your mission.

Write out your plan.

As with a for-profit organization, a business plan helps a nonprofit describe its plans to achieve its mission in specific details. It’s also commonly used as an outline for a new project or venture. A business plan’s basic structure includes an executive summary, description, industry background, competitive and market analysis, operations plan, management summary, and marketing plan, among other information. This article offers a thorough overview of the information you need to include in a business plan.

Develop your board of directors.

A board of directors makes up the governing body that will play numerous key roles and legal responsibilities. As your organization grows and develops, the board often changes. Recruitment can be an important part of this process, but developing an organized approach to growing your board through orientation, training, evaluation and then the cultivation of potential board members is essential to ensuring success for your organization.

3. Incorporate your Nonprofit

Once your research is complete, the next step is to find helpful tools near you. Each state offers nonprofit startup resources specific to your location. When you find those resources, you can look to incorporate your nonprofit. Once you have the right resources in place, incorporating your nonprofit will help you grow your business. Incorporating helps you have a formal structure that gives credibility to your foundation and its services. A corporate structure also limits the liability of an organization's officers and directors. Additionally, the IRS requires organized documentation and governance policies/procedures traditionally used with corporations. Once you incorporate your nonprofit, filing and fees will vary by state.

4. File for 501(c)(3) Tax-Exempt Status

While incorporation registers your nonprofit, it will not make it tax-exempt. To confirm its exemption status, you must apply for exempt status with the IRS. Usually, the user fee varies between $275 and $600, depending on the application method. The IRS may return its decision in between three months to a year, depending on how many questions they have about your application. You can get help with this process by seeking an experienced lawyer or account to file or review the claims before submitting them. If you can’t hire a lawyer, consider asking your board members or your state’s nonprofit association to review them.

5. Oversee ongoing compliance

Register with your state.

Each state has an agency overseeing nonprofit organizations and charitable solicitations. If you solicit contributions within other states, you might have to register your organization in those locations too.

Prep for annual reporting.

Most exempt organizations must file a Form 990 with the IRS, depending on their financial activity. This form gives a full overview of your finances, government processes, organization's activities, directors and lists key staff members. It is also open to public inspection. All states have their reporting measures and renewal requirements. Track your organization’s finances and activities, so it will help you during the review and reporting process each year or bi-annually. Charity registrations often need to be renewed each year, too.

Study the rules and regulations.

Be sure to identify which rules and regulations to follow as you continue the compliance process. Certain activities can jeopardize the nonprofit organization's tax-exempt status. Here, you can find a list of the activities that can possibly impact this status.

Conclusion.

In conclusion, forming a non-profit can be incredibly rewarding. However, making sure you follow the key steps in the formation process will help ensure the organization’s stability and long-term sustainability.